Herbert Smith Freehills

Businesses must increasingly prioritise their ESG goals. This article explores recent regulatory and policy updates in relation to sustainable finance, notable developments in sustainability-linked loans and ASIC’s enforcement action against greenwashing.

BACKGROUND

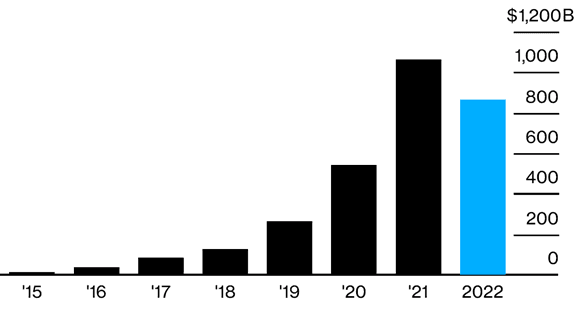

Since Adelaide Airport signed the first Australian sustainability-linked loan (SLL) in 2018, interest in SLLs has steadily risen in the Australian and broader Asia-Pacific region. Borrowers and lenders have used SLLs as a way to align financing terms with their environmental, social and governance (ESG) strategies. However, in the past year, the volume of sustainable debts issued globally, including SLLs, declined for the first time by 19% from the peak of US$1.1 trillion in 2021. Similar trends have been seen in the Asia-Pacific region.

Source: Bloomberg Despite the decrease in the volume of SLLs in the past year, SLLs remain an attractive financial product, especially given that ESG goals continue to be a key area of focus in Australian boardrooms. Institutional lenders are also continuing to work towards their targets to increase sustainable financing. For example, Commonwealth Bank has targeted $70b of funding towards sustainable finance by 2030 and Australia and New Zealand Banking Group with $50b by 2025. Despite the significant activity in the sustainable finance sector in Australia, regulation has been weak. Prior to 2023, the Australian Securities and Investment Commission (ASIC) had only issued up to $140,000 in infringement notices in response to concerns about alleged greenwashing. This seems set to change, with greenwashing as one of ASIC’s enforcement priorities in 2023. REGULATORY AND POLICY UPDATES

- Greenwashing an ASIC enforcement priority for 2023: Greenwashing was announced by ASIC as an enforcement priority in 2023. ASIC has also released an information sheet in June 2022 entitled ‘How to avoid greenwashing when offering or promoting sustainability related products’ which provides guidance about misrepresenting financial products or investment strategies as environmentally friendly, sustainable or ethical, signalling ASIC’s increased focus on the greenwashing regulation space.

- First greenwashing action by ASIC: ASIC took its first enforcement action in October 2022 for greenwashing against Tlou Energy Limited for making false or misleading sustainability related statements to the Australian Securities Exchange in October 2021. Tlou Energy Limited paid a total of $53,280 to comply with four infringement notices. The first civil court action against greenwashing was brought by ASIC against Mercer (see below) in February 2023.

- Federal Government’s sustainable financing strategy: On 12 December 2022, the Federal Government announced the development of a comprehensive sustainable finance strategy which will include the development of new standards or taxonomies for sustainable investment, further initiatives to reduce greenwashing and strengthen ESG labelling, and more ambitious participation in global forums to support climate and sustainable finance frameworks and investment. These principles are consistent with the Australian government’s increasing focus on climate risk disclosures and regulation in the finance space.

- Sustainability-linked loan principles: The APLMA, LMA and LSTA released updated versions of the Green Loan Principles, Social Loan Principles, Sustainability-Linked Principles and related guidance in February 2023, reflecting the continuing development of these products in the market.

- Orange Bond Principles: The Orange Bond Principles were released in October 2022 by the Orange Bond Initiative, which sets out guiding principles for issuers of Orange Bonds. Orange Bonds (named after the colour of the United Nations Sustainable Development Goal 5: Gender Equality) is a new asset class targeted towards addressing gender inequality. These set of principles will provide valuable guidance for borrowers and lenders wishing to incorporate sustainability performance targets (SPTs) addressing gender inequality in future SLLs.

As SLLs continue to gain traction in Australia, we have seen an increasingly diverse range of SPTs. While emissions-related SPTs continue to be popular, SPT targets in the wider ESG space have also grown.

Below is a snapshot of recent significant sustainability-linked loans in Australia, which demonstrate the broader range of SPTs being adopted by borrowers.