Commitment to Diversity, Equity, and Inclusion

The Orange Bond Initiative™ – Orange being the color of United Nations Sustainable Development Goal 5: Gender Equality – is a new asset class for gender lens investing that aims to mobilize the trillion-dollar bond market to build a gender-empowered financial system that embraces inclusion by valuing the full and meaningful participation of women, girls, and the LGBTQI+ community regardless of intersectional factors such as race, religion, region, or income.

The Orange Bond Initiative™ commits to adopting an inclusive approach when designing the guiding principles, standards, transactions, and certification tools. The Initiative does this by ensuring a diversity of views is solicited and represented across regions – including the Global South and the 99% – and across stakeholder groups – civil society, private sector, and public sector.

The Initiative aims to empower women, girls, the LGBTQI+ community, and other groups that face gender-based discrimination limiting their ability to participate fully and meaningfully in all spheres of life – economic, social, political, and environmental.

The Orange Approach to Balancing Risk-Return-Impact

As the sustainable finance market grows, it is critical to ensure scaling the size of issuances does not compromise the depth of impact achieved.

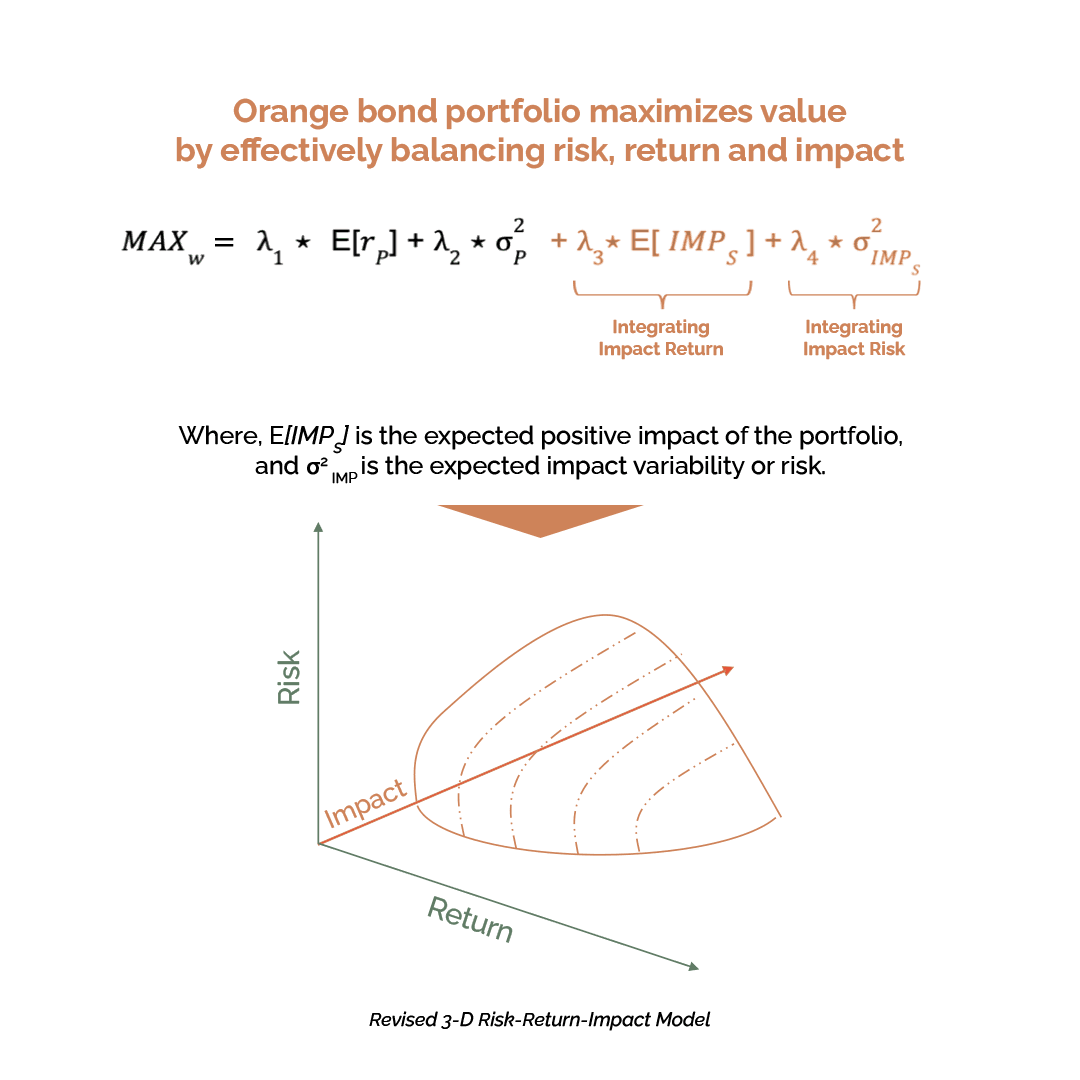

This suggests a need to go beyond traditional portfolio construction theory which aims to ‘maximize utility’ and is based on the two-dimensional model of risk and return

Building on the IIX’s Risk-Return-Impact Equation™ (RRI), the Orange Movement™ recommends constructing portfolios with the aim to maximize long-term, sustainable value to people, planet, and profitability by integrating impact into the risk-return paradigm using a three-dimensional approach instead.

This theory is supported by extensive evidence that impact related to gender equality, in particular, can have a stabilizing effect on risk and return. For instance:

Peace Dividend: Nations are less prone to engaging in militarized conflict if they have higher levels of economic, social, and political gender equality.¹

Planet or Climate Dividend: Nations with higher gender equality are better positioned to adapt to climate change.²

Prosperity Dividend: Women outperform men by an average of 40 basis points and show more investment discipline than men to achieve risk-adjusted returns.³

Sources

1. “Gendered Conflict.” Mary Caprioli, 2000 (link)

2. UN Gender Inequality Index, ND GAIN, 10-year Correlation Analysis (2011-2020)

3. "Women And Investing In 2023: Everything You Need To Know." Bankrate, 7 Mar. 2023 (link)

Tools to build Transparency

Powered by IIX Values™, the Shades of Orange™ Rating and the Orange Seal are toolkits that ensure women, girls, and gender minorities are given a voice and value.

Shades of Orange™ Shades of Orange™ is an essential component of building impact measurement and reporting for Orange Bonds. This unique rating system improves second-party opinions by using data-driven impact assessment and direct confirmation from women, girls, and the LGBTQI+ community. All Orange Bond transactions will receive a Shades of Orange rating to prevent impact-washing.

The Orange Seal The Orange Seal helps corporations and SMEs demonstrate commitment to diversity, equity, and inclusion in leadership, products, services, and supply chains. By adopting the Seal, organizations commit to prioritizing gender equality and diversity in their operations, strategy, and mission. It offers a platform to promote its gender-focused approach to consumers and stakeholders.