Capital Monitor

A Moody’s report shows increasing numbers of issuers are using sustainable bonds to support gender-equality goals.

-

Orange sight. February witnessed the first-ever sustainable bond backed by the Orange Bond Principles. (Photo by Aleksandr Khmeliov via Shutterstock)

- Moody’s reports $33bn of sustainable bonds were earmarked for gender equality projects in 2022, up from $24bn in 2021.

- The world’s first sustainable debt under the Orange Bond Principles has been issued by Impact Investment Exchange.

- Closing the gender gap in labour force participation and management positions in OECD countries would result in a 7% ($7trn) bump in global GDP.

There is still very little about gender equality that makes for happy reading.

As Capital Monitor reported at the beginning of March, the sixth annual report from gender equality data provider Equileap showed that only 28 of 3,787 public companies with a market capitalisation of more than $2bn from 23 developed markets had closed their gender pay gap over the past year.

The vast majority (78%) still have their heads in the sand and do not publish information on pay differences at all.

But there is a glimmer of some good news. A new report from Moody’s published in mid-March shows increasing numbers of issuers are turning to sustainable bonds to support gender equality goals.

In 2022, proceeds from about $33bn of green, social sustainability and sustainability-linked bonds were earmarked – in whole or in part – to finance projects tied to gender equality, up from $24bn in 2021.

More to the point, these bonds are coming from a variety of issuers. Last year supranational, non-financial companies and financial institutions each accounted for more than 20% of issuance volumes for bonds contributing to gender equality.

Last year, for example, Paris-based NGE raised €500m of sustainability-linked debt, with one of the key performance indicators (KPI) linked to female representation on construction sites. And Paris-based Keolis, which operates public transportation systems in 17 countries, signed a €600m ($681.4m) five-year sustainability-linked syndicated loan with a KPI linked to gender equality.

Nor is this an entirely European phenomenon. European issuers accounted for just over a third (36%) of issuance, while Asia-Pacific issuers increased their share of issuance to 21% from 8% in 2021. Even Latin America is getting in on the act, increasing its share of issuance from 1% to 5%.

Only the Middle East and Africa remain – what Moody’s calls – “negligible”, with its share of gender-focus issuance sat at 3% last year.

“Issuance of sustainable bonds that finance projects tied to gender equality and the empowerment of women is likely to continue growing amid robust demand from investors and mounting pressure on companies to disclose gender diversity information,” notes Erika Bruce, associate analyst at Moody’s in New York and lead author of the report.

Orange is the new black

A sign of growing innovation in the sector was the issuance of the inaugural $50m four-year 6.5% Women’s Livelihood Bond 5 (WLB5) in February from impact investors Impact Investment Exchange (IIX).

Led by ANZ, Barclays and Standard Chartered, it was the fifth bond in the series – the first was in 2017 – but crucially was the world’s first sustainable debt issued under what it has called the “Orange Bond Principles”.

Taking its name from the orange colour of the United Nations’ Sustainable Development Goal (UN SDG) 5: Gender Equality, it is potentially a new asset class for gender lens investing and aims to use the bond market to build inclusion for women and the LGBTQI+ community.

To date, the WLB Series has raised $128m and says it has met or exceeded all its impact targets, collectively empowering 1.3 million women and girls from emerging markets in Asia and Africa.

“The Covid-19 pandemic and the climate crisis have aggravated gender disparity, and women in the Global South are left to bear the brunt of it,” says IIX’s chief executive and founder Durreen Shahnaz.

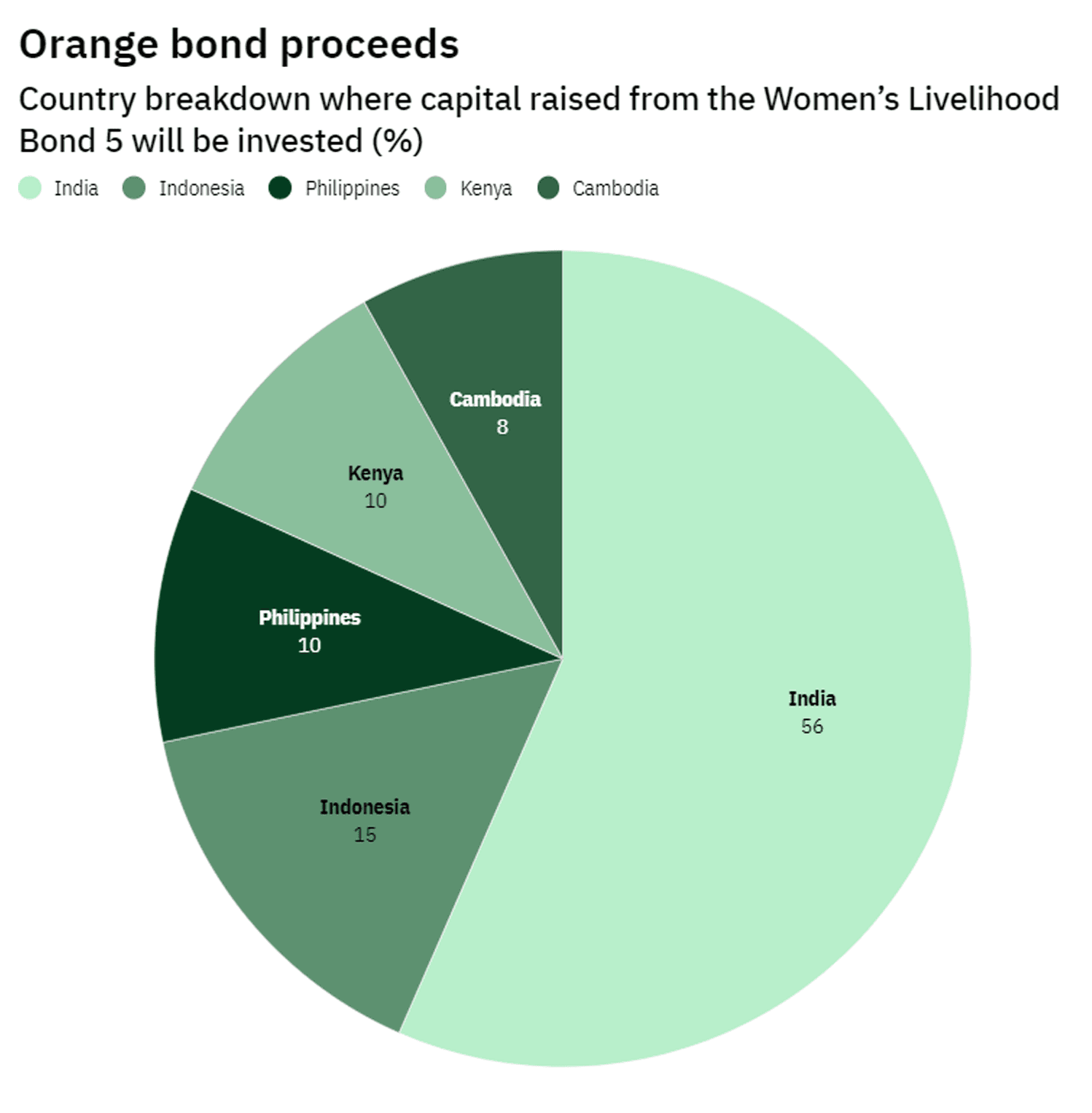

Source: IIX Global Charitable

Gareth Deiner, a partner at Clifford Chance, worked on the deal and called it a “strategic inflection” of the global sustainable financing market.

The structure securitises a portfolio of loans to high-impact enterprises which cannot usually access international capital markets. Proceeds will be used to make loans to enterprises in Cambodia, India, Indonesia, Kenya and the Philippines that will operate across six sectors: microfinance, SME lending, clean energy, sustainable agriculture, water and sanitation, and affordable housing [see chart].

The second-party opinion was carried out by IIX Global Charitable. The portfolio manager will report on the impact performance of the borrowers twice a year. At the mid-point of each reporting year, the portfolio manager will monitor and provide a progress report, charting out the impact performance of the borrowers both as individual entities and in aggregate.

Anchor investors were Nuveen, Laerdal Finans, Pathfinder New Zealand, and Ceniarth.

Sarah Ng, a director of debt capital markets at ANZ, says demand for the bond came from across Asia-Pacific, Europe and the US. Supported by a strong, repeat investor base, she adds that she expects this significant appetite for impact investing to continue.

Sustainable bonds: A 7% bump in GDP…

“Gender equality is key to achieving sustainability,” says Stephen Liberatore, lead portfolio manager for US asset manager Nuveen’s fixed income strategies that incorporate ESG criteria and impact investments ($1.3trn AUM), who was close to the deal.

Moody’s Analytics estimates that closing the gender gap in labour force participation and management positions in OECD countries would result in a 7% ($7trn) bump in global GDP.

“Sustainability-linked bonds present an opportunity for an array of issuers to integrate gender equity into their decarbonisation financing structures,” notes Moody’s.

Markets are getting there. Despite the stresses on capital markets last year, the share of sustainable bonds supporting gender equality doubled in 2022 to 4%, according to Moody’s. With expectations that sustainable bond issuance overall will rebound 10% to $950bn this year, expectations are that gender financing will also rise.