Orange Bonds: A cross-cutting asset class for investing in gender equity

Unlocking the potential of women could add a staggering US$28 trillion to the global economy by 2025. Annual issuances of Green, Social, Sustainability, and Sustainability-Linked (GSSS) Bonds advancing gender equality almost doubled to reach US$33 billion in 2022, highlighting the increasing scope for Orange-labelled issuances.

That's why we launched the Orange Bond - a sustainable debt asset class for investing with a gender lens. Orange Bonds are designed with the Global South and North having an equal seat at the table and the 99% at the core of our efforts to build a financial system that embraces diversity, equity, and inclusion.

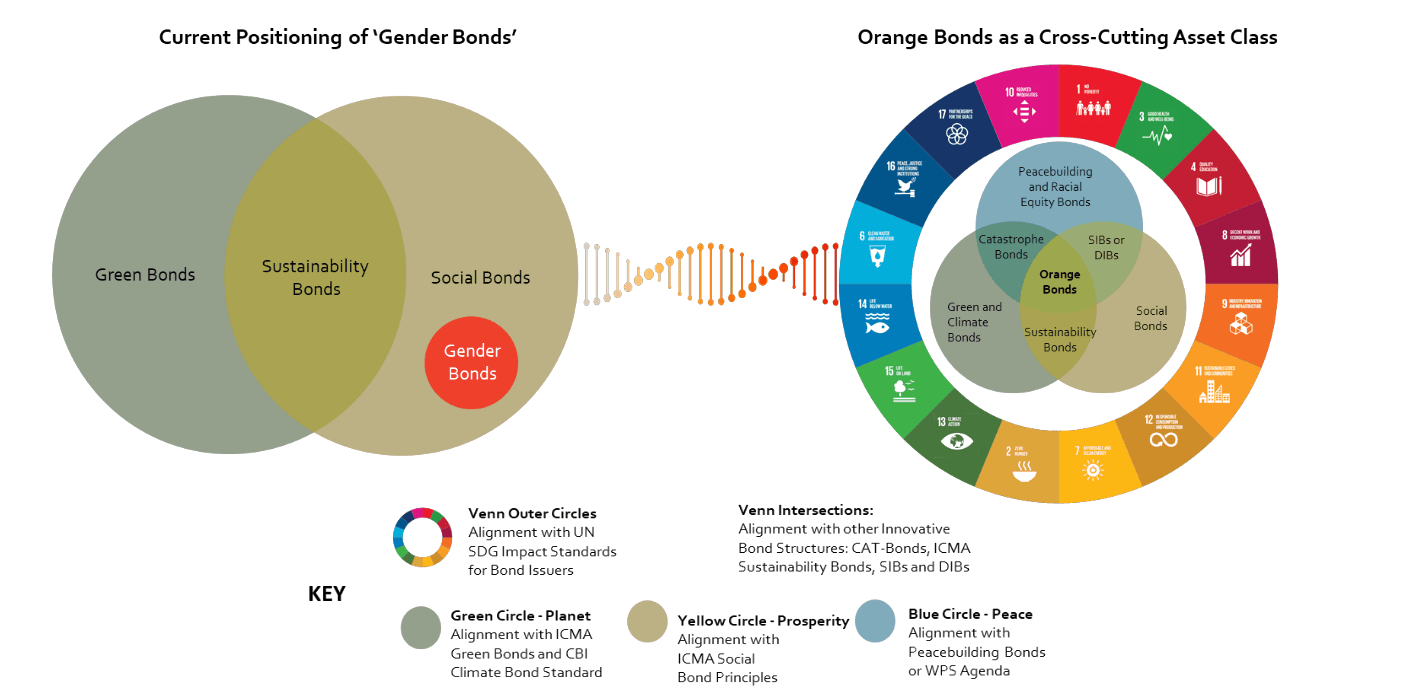

Orange Bonds are a cross-cutting asset class and have been harmonized to complement existing market standards such as the ICMA GSSS Principles. This distinguishes Orange Bonds from ‘Gender Bonds’ as an undefined asset class or a subset of Social Bonds and positions them to achieve a multitude of outcomes and co-benefits related to prosperity, peace, and planetary or climate resilience.

ORANGE BOND PRINCIPLES™

The Orange Bond Principles™ (OBP) published in October 2022 is a set of guidelines to support issuers, investors, arrangers, and approved verifiers involved in facilitating Orange Bond transactions.

To qualify as an Orange Bond, transactions are expected to align with three overarching principles: (1) Gender-Positive Capital Allocation; (2) Gender-Lens Capacity and Diversity in Leadership; and (3) Transparency in the Investment Process and Reporting.

Issuers will be required to secure an external review from an Approved Verifier.